Flexible, Open Processing Choices

Choose the processor right for your business.

As a trusted partner of PAX, Datacap’s NETePay, and Dejavoo, MicroSale offers seamless integration with virtually every EMV device and processor available in the US.

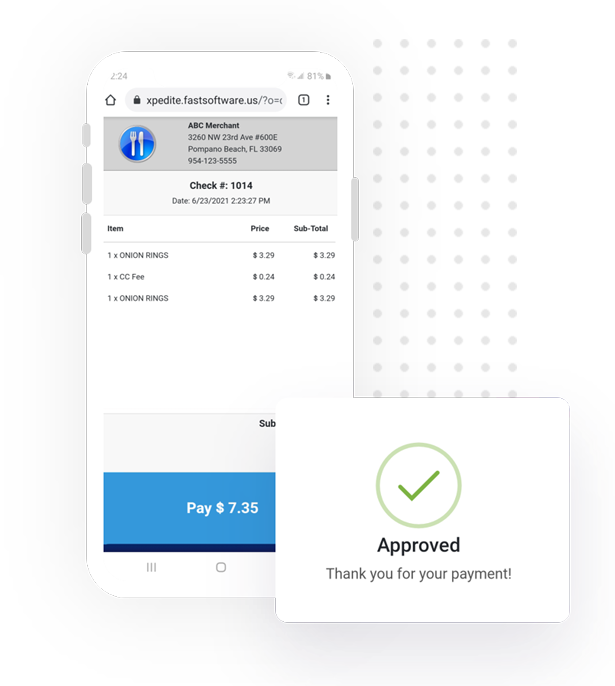

CHIP CARDS

| MOBILE WALLETS | QR CODES

| ONLINE PAYMENTS | GIFT CARDS

- P2PE Validated Application

- SHA-256 Encrypted

- 24 Hour Support

- Supporting both cash discount options: dual-pricing and surcharging

- EMV Processing flexibility

Future-proof your business with modern, secure, convenient payments.

In today’s rapidly evolving restaurant industry, customers expect modern and convenient ways to pay. With the right payment technology, you can not only improve customer experience, but also streamline operations, for increased profitability and long-term success.

Nearly eliminate processing fees with cash discounting

Restaurants looking to eliminate credit card processing fees can take advantage of cash discount options. These options were introduced by credit card processors to offset merchant processing fees by passing fees to customers who pay by credit card. MicroSale supports both available cash discount options on the market.

Find out how we can help you.

Copyright © 2024 KIS Software, Inc., DBA MicroSale POS Systems All rights reserved.